Tax & spender blames AR budget reduction on not imposing more taxes

Watch out. Tax and spenders are using every excuse to try to increase your Arkansas tax burden through an internet sales tax. The latest excuse is the budget revision announced by Governor Asa Hutchinson. He announced a $70 million reduction in the state’s $5.33 billion general revenue budget. Less revenue has come in than he was hoping for in his budget. Not to worry – the Governor says the budget reduction won’t affect state services. It will only impact some items in the lower priority spending categories.

It must be embarrassing to have to make cuts just a few weeks after you got your annual budget passed, and the new budget doesn’t even kick in until July.

Bad budgeting? Over spending? Not according to a state Representative who blames the shortfall on the failure to increase your tax burden even more through an internet sales tax.

If you think this sounds like the reasoning of some wild-eyed liberal like Elizabeth Warren or Nancy Pelosi, you would be wrong.

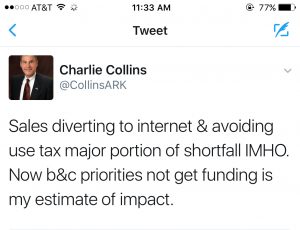

The argument is being made by an Arkansas Republican, State Representative Charlie Collins of Fayetteville. Here is what he said on Twitter: “Sales diverting to internet & avoiding use tax major portion of shortfall IMHO. Now b&C priorities not get funding is my estimate of impact.”

The argument is being made by an Arkansas Republican, State Representative Charlie Collins of Fayetteville. Here is what he said on Twitter: “Sales diverting to internet & avoiding use tax major portion of shortfall IMHO. Now b&C priorities not get funding is my estimate of impact.”

In other words, the new state budget was perfect and could have been fully funded if we dumb citizens had just been willing to go along with paying more through an internet sales tax.

This t ax and spend attitude may work for Democrats, but a Republican?

ax and spend attitude may work for Democrats, but a Republican?

The fact is – you can’t blame the budget shortfall on failure to impose a sales tax on out-of-state purchases.

FIRST, even if the internet tax had passed, Arkansas wouldn’t see any extra tax money for a long time, if ever. The internet sales tax bill (SB140) by its own terms anticipated that no tax would be collected until court challenges were considered. There is no telling how long it would take for the issue to go through the court system and be considered by the U.S. Supreme Court. Once the issue made it to the Supreme Court it is likely the law would be found unconstitutional. For many decades, the U.S. Supreme court has said you can’t require an out-of-state seller to collect sales tax if the seller does not have stores or facilities in the state.

SECOND, you can’t blame this budget reduction on out-of-state sales when Arkansas has been budgeting for decades knowing the current use tax is basically uncollectible from individuals who shop out-o0 state stores by a catalog or by online purchase. Arkansas knows this and so does every other state!

Representative Charlie Collins’ argument falls flat.

Having to reduce the budget even before the legislature officially adjourned the Regular Session…. that’s just bad budgeting and over spending. The fact that the cuts won’t impact services show how much some politicians love to tax and spend.