“Arkansas Works” – You work so others don’t have to

,

Governor Asa Hutchinson is pushing the legislature to continue and to expand the Obamacare Private Option program as “Arkansas Works”.

Governor Asa Hutchinson is pushing the legislature to continue and to expand the Obamacare Private Option program as “Arkansas Works”.

As soon as the Obamacare Private Option program began, supporters started saying the state can’t stop the program because thousands of people would lose coverage. But if the Private Option/ Arkansas Works ended, what would it take for an enrollee to instead qualify for subsidized Obamacare under an Obamacare Exchange?

To remain eligible for the Private Option/ Arkansas Works, a person cannot exceed income above 138% of the federal poverty level. A person with income above the poverty level are eligible for federally subsidized insurance on the Obamacare Exchange.

If the Private Option/ Arkansas Works goes away, how hard would it be for enrollees to qualify for the federally subsidized insurance? A person becomes eligible for federally subsidized insurance on the Obamacare Exchange by working about 28.1 hours a week at the current Arkansas minimum wage of $8.00 an hour. Next year the Arkansas minimum wage increases to $8.50 per hour and a person would only have to work 26.4 hours of per week per week to be eligible.[i] The number of hours also falls as the person’s salary increases above minimum wage.

This part-time schedule is highly significant. Arkansas Works is overwhelmingly for people who are ABLE BODIED WORKING AGE ADULTS WITH NO CHILDREN. Nearly half do not work at all. And, “No” the Private Option/ Arkansas Works is not for the disabled or the elderly, or pregnant women, or children. We cover those people under traditional Medicaid.

With such a low threshold it looks like “Arkansas Works”:

- Is more about profits for insurance companies and hospitals than about health care

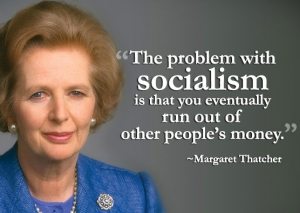

- Keeps Arkansans dependent on the government

[i] 11-4-210. Minimum wage.

(a) (1) Beginning October 1, 2006, every employer shall pay each of his or her employees wages at the rate of not less than six dollars and twenty-five cents ($6.25) per hour except as otherwise provided in this subchapter.

(2) Beginning January 1, 2015, every employer shall pay each of his or her employees wages at the rate of not less than seven dollars and fifty cents ($7.50) per hour, beginning January 1, 2016, the rate of not less than eight dollars ($8.00) per hour, and beginning January 1, 2017, the rate of not less than eight dollars and fifty cents ($8.50) per hour, except as otherwise provided in this subchapter.

(b) With respect to any full-time student attending any accredited institution of education within this state and who is employed to work an amount not to exceed twenty (20) hours during weeks that school is in session or forty (40) hours during weeks when school is not in session, the rate of wage shall be equal to but not less than eighty-five percent (85%) of the minimum wage provided in this section.